- The outlook for crude oil is boosted by conflict in the Middle East while strengthening economic data reduces fears over demand.

- US attacks on “Iran-affiliated groups” in Iraq are condemned as “contributing to a reckless escalation” of the crisis.

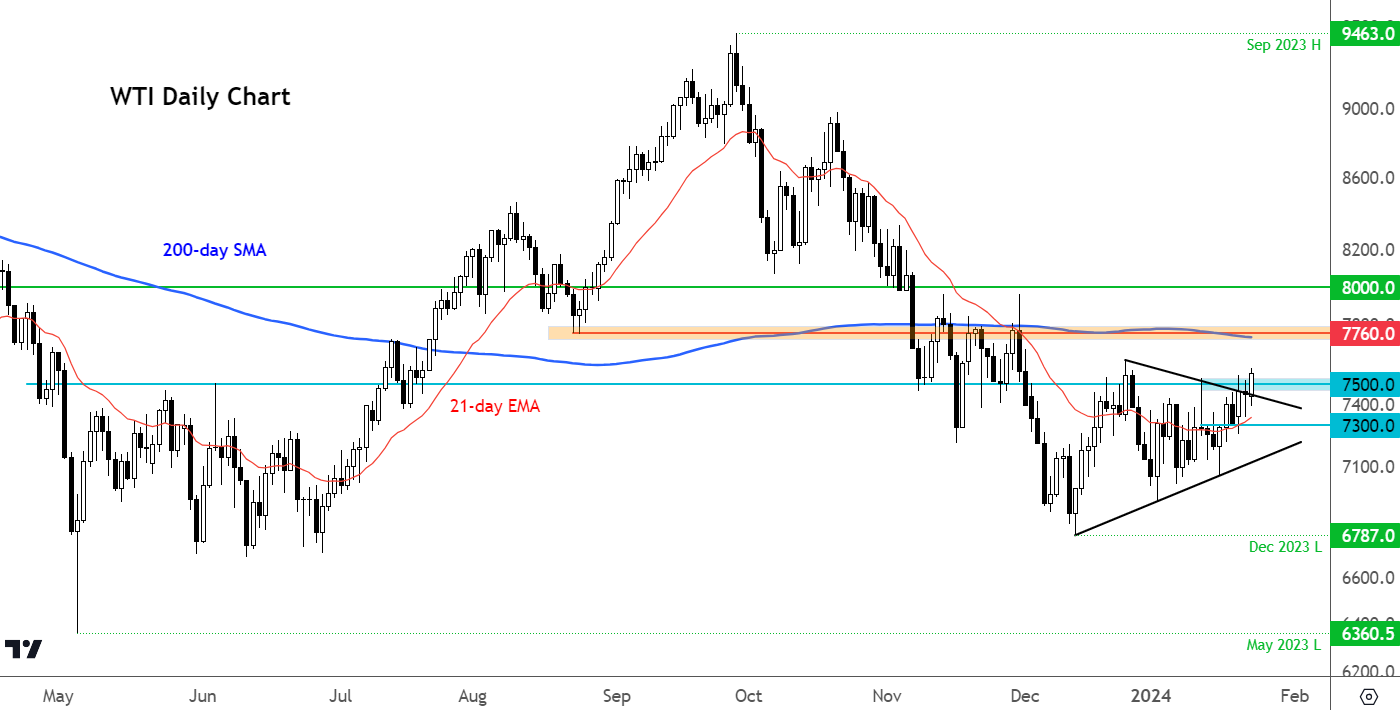

- WTI crude oil technical levels to watch include $75 on the downside.

The outlook for crude oil is boosted by conflict in the Middle East, while strengthening economic data reduces demand fears. US attacks on “Iran-affiliated groups” in Iraq have been condemned as “contributing to a reckless escalation” of the crisis. WTI crude oil technical levels to watch now include $75 on the downside.

Crude oil rebounded and gained momentum after earlier weakness. WTI crude oil is at its best levels of the year, surpassing $75 while Brent has surpassed $80 per barrel. Ongoing tensions in the Middle East have kept oil prices higher this month, rebounding after three months of declines last quarter. WTI tried once again to cross the $75 mark yesterday, but failed to hold. Will she be able to overcome this obstacle in a more meaningful way this time around? So far, it looks promising.

Crude Oil Outlook: Geopolitics and Chinese Optimism Support Oil

Oil prices regained support at the start of the year, largely thanks to growing tensions in the Middle East, which are sparking supply fears. The latest progress comes after targeted attacks on “Iran-affiliated groups” in Iraq, which the latter condemned, saying the US action was “contributing to a reckless escalation” of the crisis.

Ongoing tensions and conflicts in the Middle East, which threaten global supplies, have consistently helped push oil prices higher despite short-term declines recorded so far this month.

Additionally, extreme cold conditions across the United States are limiting crude oil production in North Dakota and hampering production in various other states. As of Monday, more than 20% of production in North Dakota, the third-largest oil-producing state, remained offline, according to Reuters.

Additionally, the current risk climate is optimistic, marked by the fact that all three major US stock indices hit new record highs this week.

China also intervened overnight to support its ailing markets, causing local markets and China-linked commodities like copper to rebound. This positive risk sentiment in stock markets and elsewhere is also contributing to an increased appetite for other risky assets, notably crude oil.

Demand worries fade but dollar poses risk

One source of concern for oil traders is the U.S. dollar, which has shown resilience so far this year, making dollar-denominated commodities more expensive for foreign buyers. If the US dollar further extends its advance this week, with key data coming, it could potentially hurt crude oil. However, any strength in U.S. data from stronger data would also boost the crude oil demand outlook. So it’s not as simple as that.

Until this month’s recovery, the three-month decline in the fourth quarter occurred despite OPEC+ holding back supplies as concerns over demand limited any significant rise. But those concerns were eased by U.S. data that far exceeded expectations this month. Consistent with this trend, the manufacturing (50.3) and services (52.9) PMIs today exceeded expectations in the United States.

Earlier in the day, European PMIs were mixed, with figures higher in the UK and missing for Germany.

Crude Oil Outlook: WTI Technical Levels to Watch

If you are bullish on oil, you may want to wait to see if WTI can sustain the breakout above $75 for confirmation. It looks like it might be possible after several failed attempts over the past few weeks.

The recent break of the 21-day exponential moving average by WTI crude oil provides some comfort to the bull camp as the US oil contract persists in testing resistance at $75.00. A decisive break above $75.00 for WTI could trigger additional technical buying, potentially targeting the next resistance at the 200-day moving average around the $77.50 to $77.60 range.

Conversely, if resistance at $75.00 holds and there is a subsequent break of support around $73.00, this would indicate a bearish outcome. In such a scenario, WTI crude oil could fall towards its December low of $67.87.

There are therefore two potential tactical scenarios that we are monitoring on oil, with a preference for the bullish scenario. Keep a close eye on prices.