- Bitcoin Spot ETF approval by US financial regulator on January 10 ignited fee wars between issuers.

- Crypto expert Vijay Boyapati believes that BlackRock, Fidelity, and Grayscale are likely to emerge as survivors in the long term.

- Bitcoin price rallied nearly 9% weekly and BTC gains were capped below the $48,000 level.

Bitcoin Spot ETF was approved by the US Securities and Exchange Commission, marking January 10 as a historic moment for BTC holders. The approval has triggered fee wars among issuers and experts weigh in on who is likely to survive in the long term, offering near zero fee to market participants.

Daily Digest Market Movers: Bitcoin ETFs receive SEC greenlight, issuers compete for market share

- Bitcoin ETF approval marked the end of an era of anticipation among market participants, the next catalyst for BTC price is the upcoming halving event in April 2024.

- The approval ushered in competition among issuers to offer the lowest fee and capture the largest market share.

- Vijay Boyapati, a crypto expert and author shared his views on issuers that are likely to survive long term, and offer near zero fees on Bitcoin Spot ETFs.

- Boyapati believes that BlackRock, Fidelity and Grayscale’s Bitcoin ETF products will survive in the long term.

- According to the expert, asset management giant Blackrock is big enough to handle zero margin indefinitely, Fidelity has a large enough client base and Grayscale is likely to differentiate itself with the largest volume of Assets Under Management (AUM).

- Approved Bitcoin ETFs and their reported fees are as follows:

Grayscale (GBTC) 1.5%

Hashdex (DEFI) 0.9%

Valkyrie (BRRR) 0.49%

Invesco (BTCO) 0.39%

Wisdom Tree (BTCW) 0.3%

Franklin (EZBC) 0.29%

Blackrock (IBIT) 0.25%

Fidelity (FBTC) 0.25%

Vaneck (HODL) 0.25%

Ark 21 (ARKB) 0.21%

Bitwise (BITB) 0.2%

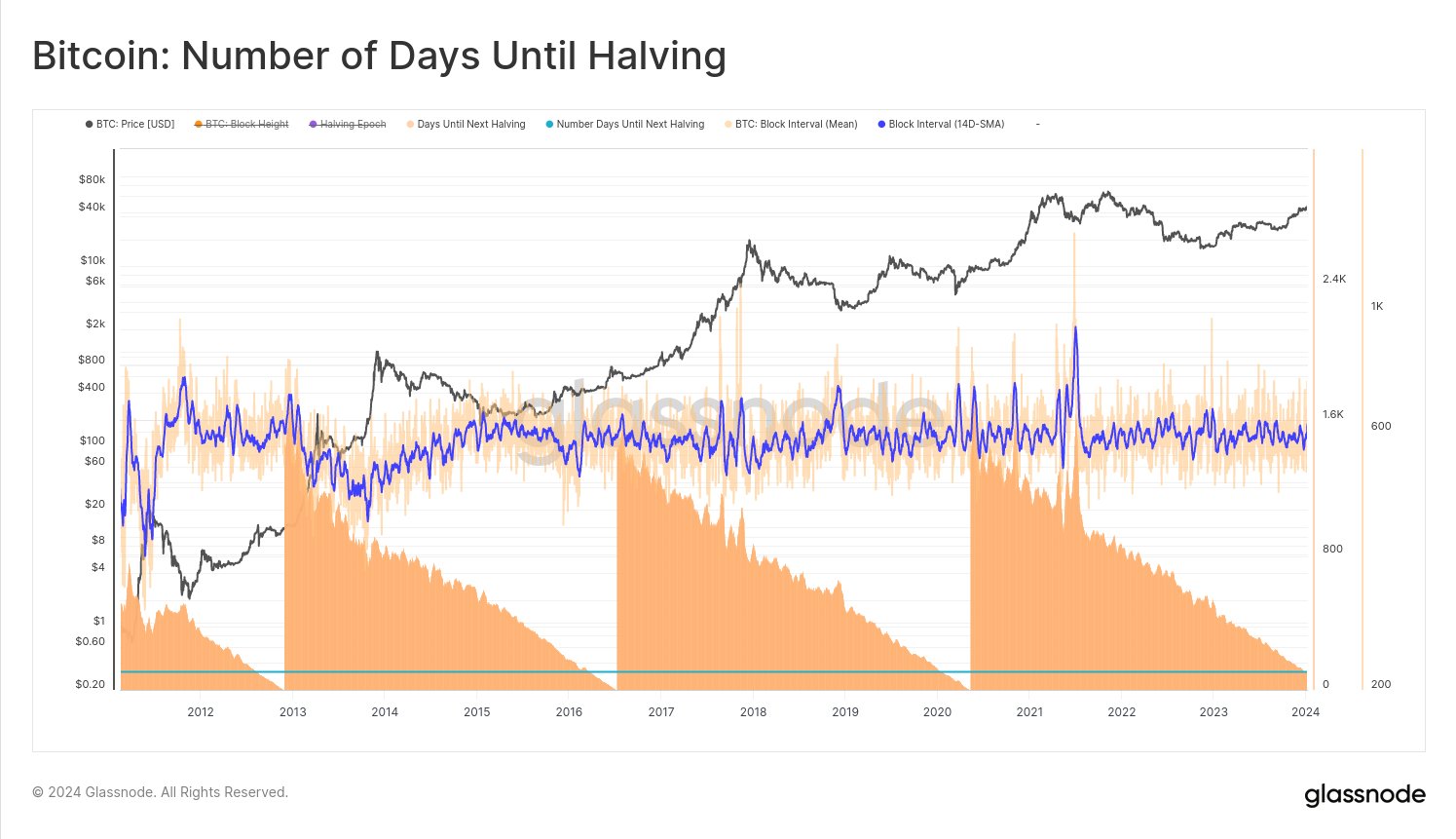

- The upcoming Bitcoin halving event is likely to act as a catalyst for BTC price. The halving is less than a 100 days away and historically, BTC price has rallied post halving.

Bitcoin Number of Days until Halving. Source: Glassnode

Technical Analysis: Bitcoin price finds strong support at $45,000, capped below $48,000

Bitcoin price rallied in response to the optimism from BTC Spot ETF approval by the US financial regulator. There are two key catalysts that were expected to drive gains in BTC. Whether BTC price rallies once Spot ETFs start trading remains to be seen.

The announcement revealed that Bitcoin’s upside is capped below $48,000. Bitcoin price rallied to $47,690 post the SEC’s approval and BTC continues to trade sideways below the $48,000 level on Thursday.

Analysts at Skew @52kskew believe that as long as Bitcoin price holds above $44,700, BTC is in an uptrend. The asset faces resistance between $47,000 and $48,000 on a High Time Frame.

BTC/USDT 4-hour chart Source:Skew tweet on X

CRYPTO ETF FAQS

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.