- Bitcoin price dropped to $41,707, and BTC price made a comeback above $42,500 on Monday.

- Rising Bitcoin supply on exchanges saw BTC fear and greed index shift to neutral.

- Bitcoin whales engaged in profit-taking as the BTC price slipped from $46,900 to $41,700, according to Santiment data.

Bitcoin price slipped to its support zone as market participants turned their attention to Ethereum and altcoins. BTC Spot ETF approvals by the Securities and Exchange Commission (SEC) turned out to be a “sell the news” event with Bitcoin suffering a decline in its price.

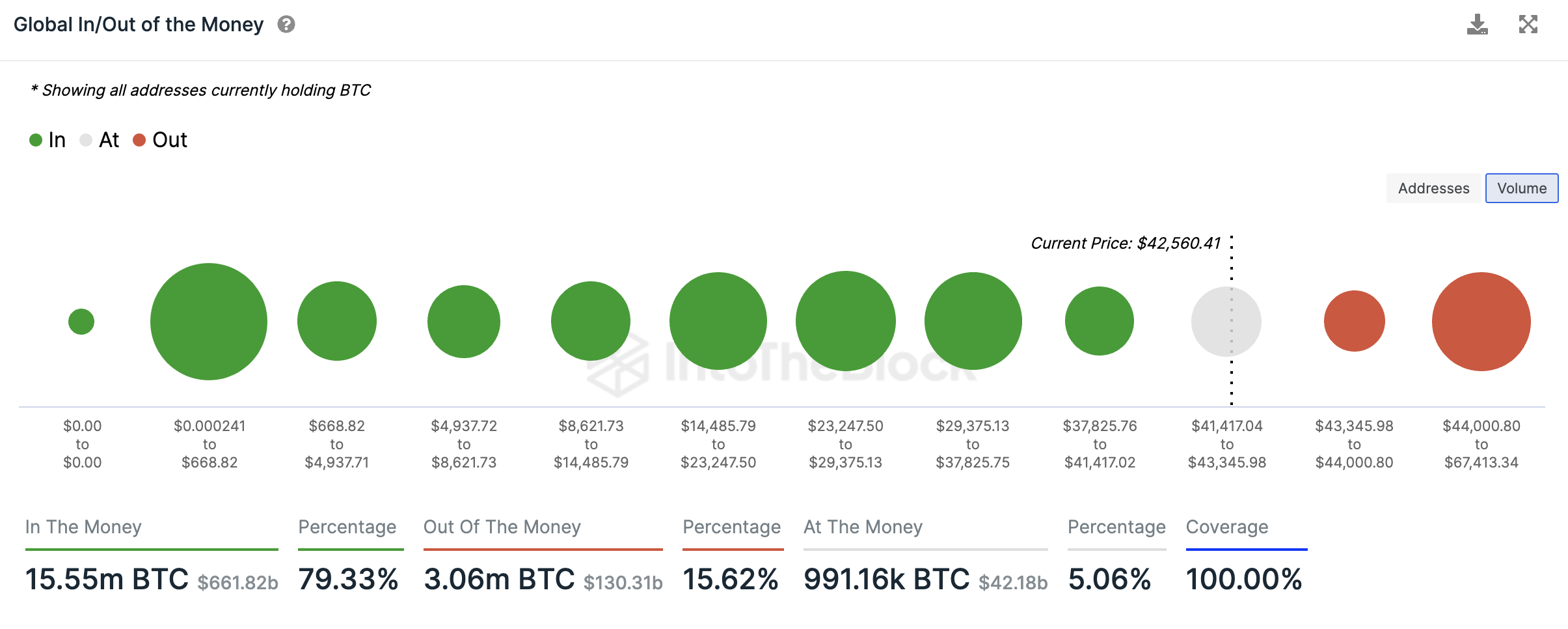

At the current price, 79.33% of BTC wallet addresses are profitable. The number is expected to increase as Bitcoin begins its recovery.

Crypto experts have commented on BTC issuers’ accumulation of the asset, this could likely catalyze a recovery in the cryptocurrency as it fuels demand for the digital currency.

Daily Digest Market Movers: Bitcoin ETF issuers could amass more BTC than largest public holders

- Luke Broyles, a crypto expert on X believes that at the current rate, BlackRock could own more Bitcoin than MicroStrategy by February 1. Broyles argues that this could change if current rates slow down or Bitcoin price rallies.

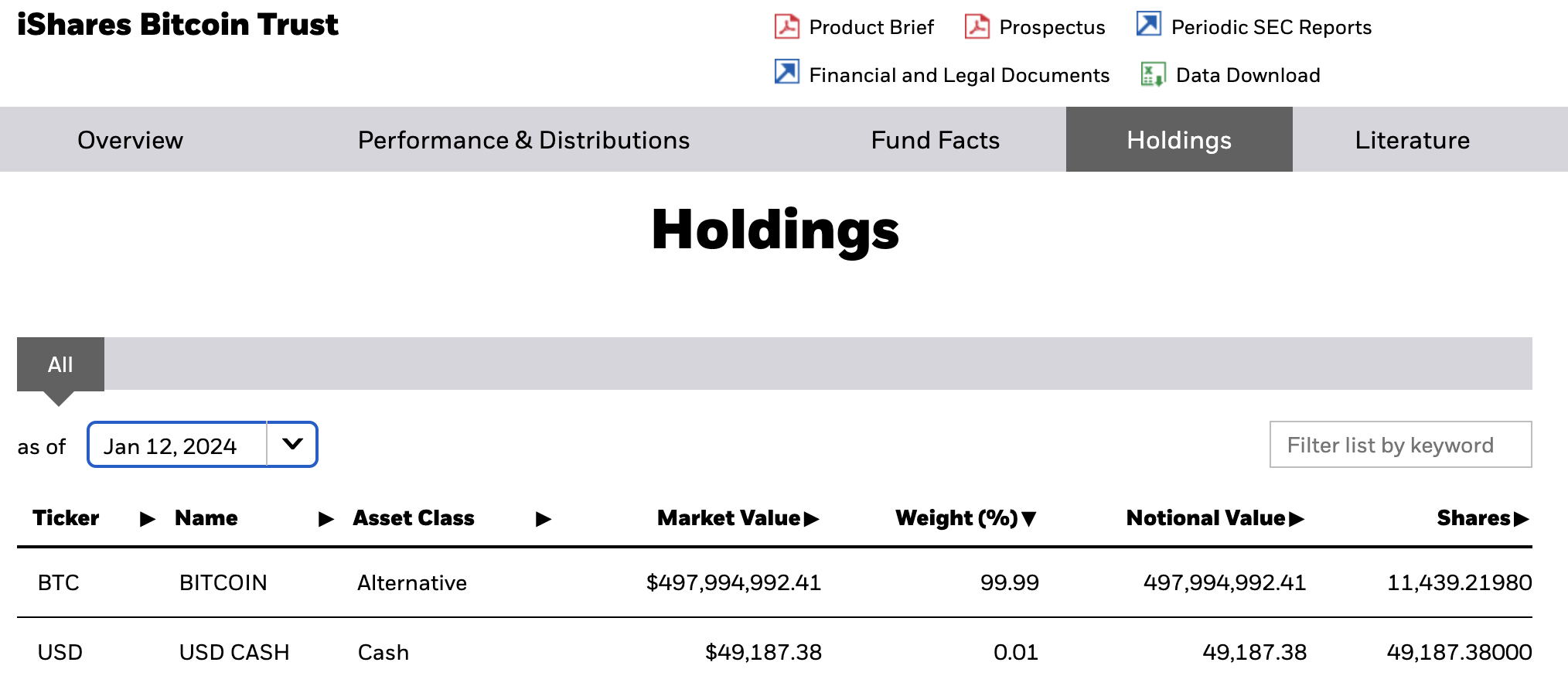

iShares Bitcoin Trust of BlackRock holds over $497 million in BTC. Source: iShares website

- Demand for Bitcoin from ETF issuers could catalyze a recovery in BTC price as the asset’s downtrend hits pause at $41,700.

- BTC price is likely to begin its recovery towards the $43,345 level as the asset is currently in a support zone ($41,417 to $43,345) where 2.93 million addresses acquired 991,100 BTC, according to IntoTheBlock data.

Global In/Out of the Money. Source: IntoTheBlock

- Factors that likely contributed to Bitcoin’s recent decline include the rising exchange supply of BTC and profit-taking activities by whales.

- BTC supply on exchanges climbed from a six-month low of 5.30% on January 7 to 5.39% on Monday. Typically, an increase in the asset’s supply on exchanges is considered bearish as it may contribute to rise in selling pressure.

%20[10.29.32,%2015%20Jan,%202024]-638408954652267750.png)

Bitcoin supply on exchanges. Source: Santiment

- Santiment data reveals how the recent spikes in whale transactions valued at $100,000 and higher coincide with spikes in Network Realized Profit/Loss metric. This means, large wallet addresses are taking profits, and this is another factor that could push BTC price lower, according to Santiment data.

%20[10.29.36,%2015%20Jan,%202024]-638408954915221686.png)

Bitcoin whale transactions and network realized profit/loss. Source: Santiment

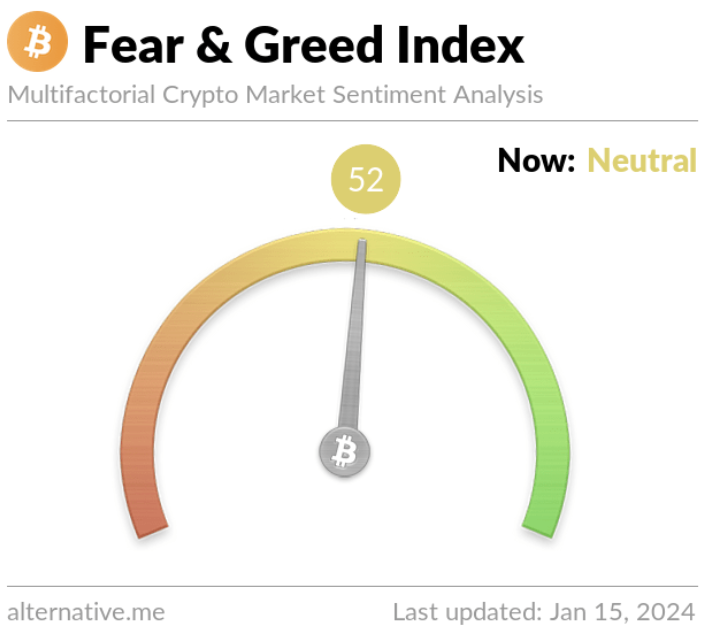

- The Bitcoin Fear and Greed index that analyzes the current market sentiment of BTC holders. This indicator shows that the sentiment has shifted from “Extreme Fear” to neutral.

Bitcoin Fear and Greed Index. Source: Alternative.me

Technical Analysis: Bitcoin price eyes recovery after price drops to $41,700

Bitcoin price plummeted to the $41,707 level, below its two long-term Exponential Moving Averages (EMAs) at 10 and 50-day, $43,710 and $42,094 respectively. BTC hit a two-year peak $48,989 on January 11, before dropping to support at $41,707.

BTC price recovery to the 50% Fibonacci retracement ($43,074), of the decline from November ‘21 peak to November ‘22 low, is likely.

BTC/USDT 1-day chart

A daily candlestick close below the 38.2% Fibonacci Retracement level at $36,747 could invalidate the bullish thesis for BTC price.

CRYPTO ETF FAQS

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.