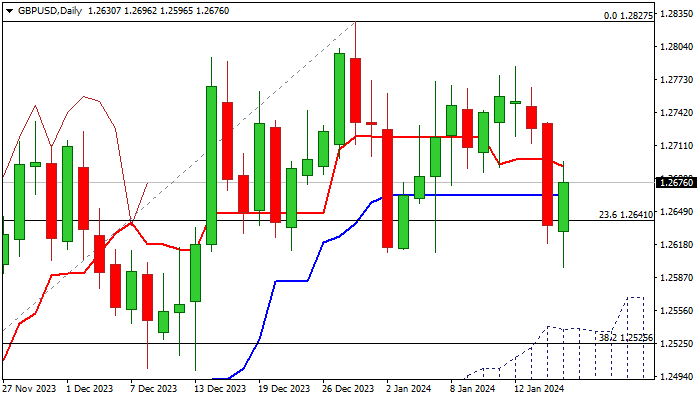

GBP/USD

Cable jumped around 0.4% in European trading on Wednesday, lifted by above forecast UK December inflation data, which soured the sentiment about rate cut, pushing percentage of bets for rate cut by May significantly lower.

Fresh gains move the price from dangerous zone after the price retested the floor of larger range at 1.2600 zone, which extends into fifth consecutive week.

Although the price action moved into range’s mid-point, there is still notable lack of clearer direction signals, as negative momentum on daily chart is strengthening, but moving averages are mixed and rising and thickening daily cloud continues to underpin.

Look for initial bullish signal on close above 10DMA (1.2715) which will be verified on extension above 1.2785 (Jan 12 top), with signal of bullish continuation of larger uptrend from 1.2037 (Oct 4 low), expected on clear break above pivotal 1.2830/40 zone (range top / 200WMA).

Conversely, sustained break of range floor would signal that larger bulls are losing traction, but violation of more significant supports at 1.2545/39 (200DMA / daily cloud top) will be required to signal reversal.

Res: 1.2696; 1.2715; 1.2785; 1.2843.

Sup: 1.2596; 1.2545; 1.2526; 1.2500.