- Bitcoin is trading sideways below the $43,000 level on Thursday.

- BTC halving event, which is 110 days away, is considered a typical catalyst for Bitcoin price.

- Altcoin season kicked off on January 14 as BTC dominance shrunk to 47.5%.

Bitcoin (BTC) market participants look indecisive as BTC trades sideways below $43,000 on Thursday. Bitcoin price has declined nearly 8% in the past week after the sport Exchange Traded Fund failed to support prices, giving way to a so-called “altcoin season.” The BTC halving event, which is considered a catalyst for Bitcoin price, is 110 days away.

Daily digest market movers: Bitcoin price action disappoints traders

- Bitcoin price has fallen well below its two-year high of $48,989, declining nearly 8% in the past week.

- BTC price action disappointed market participants since the approval of the ETFs. This has lead to a decrease in Bitcoin dominance, which has dropped to 47.5%, according to data from CoinGecko.

Bitcoin dominance. Source: CoinGecko

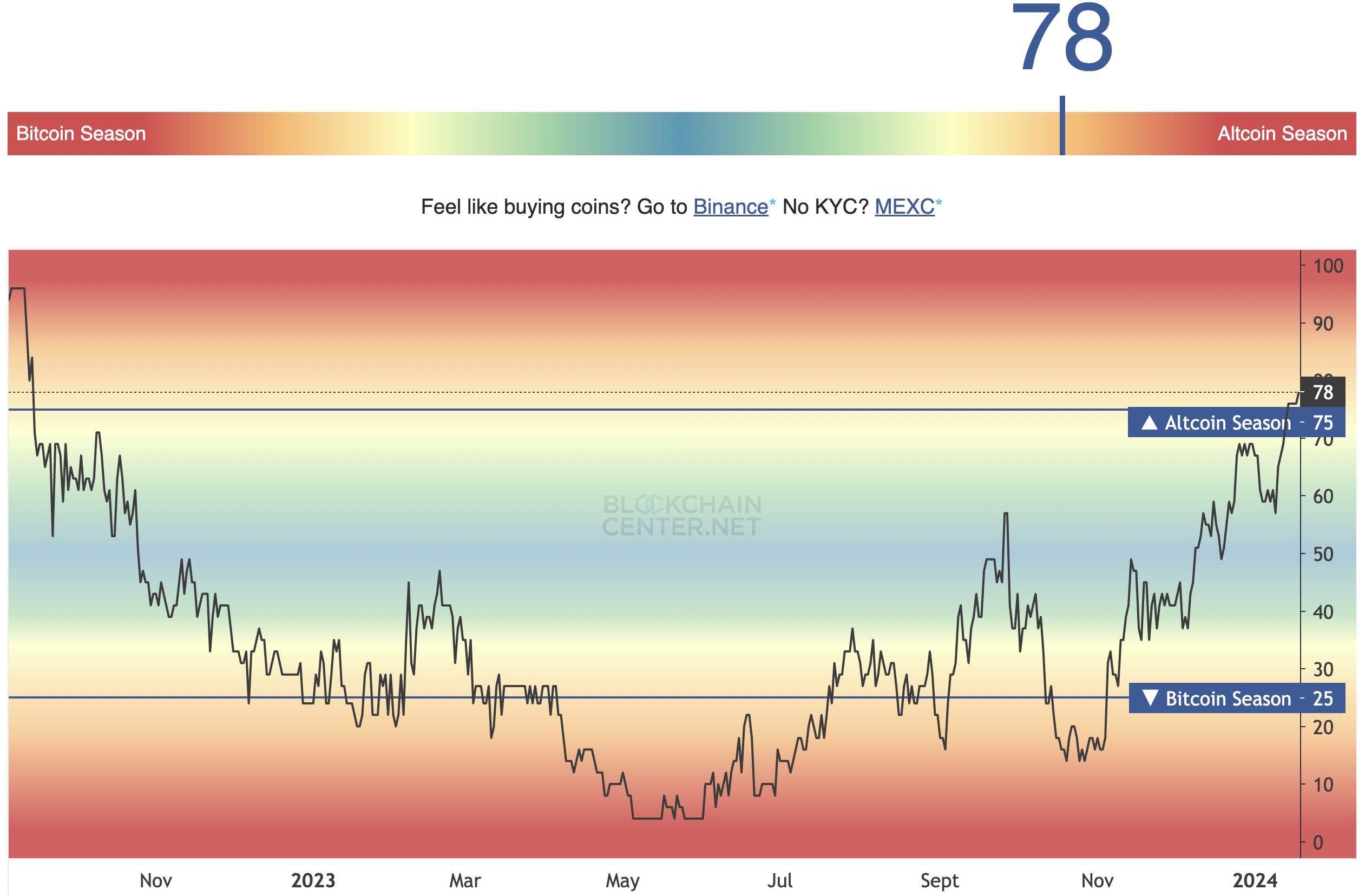

The Altcoin Season Index, which tracks whether 75% of the top 50 cryptocurrencies performed better than Bitcoin, reads 78 on Thursday. This indicator also signals that the “Altcoin Season” kicked off on January 14 for the first time since end-2022.

Altcoin Season Index. Source: Blockchaincenter.net

Experts consider the Bitcoin halving event a catalyst for BTC price, mainly because prior halving events have come together with price increases. The halving event is 110 days away, according to data from the countdown timer on Nicehash.com. The event will slash the reward for mining BTC blocks, meaning miners will receive half the current reward for verifying transactions on the Bitcoin blockchain.

The mining reward will be slashed to 3.125 BTC per block after the fourth halving in April.

Technical Analysis: Bitcoin price trades below $43,000

The start of the Altcoin season is likely taking the shine away from Bitcoin price action as investors shift their preferences towards other cryptocurrencies. In this context, BTC price is trading sideways below the $43,000 level on Thursday. In the past week, BTC price dropped nearly 8%.

The asset’s price has dropped below the 50% Fibonacci retracement level of the price decline between November 2021 and 2022 at $43,074. This marks a key resistance in BTC price recovery. The other two key resistances are marked as R1 and R2 in the chart below, representing the imbalance zone between $43,589 and $45,613.

BTC/USDT 1-day chart

A daily candlestick close above the $43,074 level could invalidate the bearish thesis for Bitcoin price.

OPEN INTEREST, FUNDING RATE FAQS

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.