Outlook: Today it’s existing home sales, TICS, and the University of Michigan household survey. Existing home sales are expected to rise by 0.3% in Dec after 0.8% in Nov but of course as mortgage rates fall, those numbers would double. Normally these would not affect FX much, but traders are still looking for reasons to go back to the early rate cut idea or jump ship entirely.

The FX market is struggling to hold two opposing ideas in its head at the same time. Yes, inflation data points to rate cuts. That’s not really in doubt. The timing is what is in doubt, and when the yields go up on the postponement narrative, the dollar tags along. But it’s vulnerable to new data, in either direction, as we saw with retail sales. The next bit of news could be a downer and restore the fast-cut idea.

We are seeing the same thing in sterling, which seesawed on a decent drop in inflation and then bad retail sales, with yields mirroring the data. We would say the BoE is more ambiguous than the Fed but it’s the same story.

Bloomberg has a classy way of expressing the nub of the matter: “Bond traders are increasingly convinced that the inversion in US Treasury yields is headed toward normalizing, though how and why this happens will mean volatility will continue. The question being asked is whether yields will sink on the short-end of the curve as rate cuts emerge, or whether 10-year yields will rise more in a higher-for-longer scenario. The Federal Reserve continues to push back against current wagers for rate cuts, with Raphael Bostic the latest to urge caution given the global uncertainty overshadowing 2024. The Fed’s Austan Goolsbee and Mary Daly are due to speak on Friday.”

Forecast: It’s Friday and there is another holiday coming up on Monday—Presidents Day. US markets are closed, as we just had with Martin Luther King Day. Aside from stocking up on new sheets and towels, the public doesn’t much celebrate and given the woke/anti-woke divisiveness, the word holiday is a misnomer.

While the market overreacts to every data release, it has yet to let go of the hope that the Fed will cut early—maybe not March, but May/June. In Europe, ECB chief Lagarde says “summer,” which can include June if you squint. So the question becomes whether the FX market has already priced in the cut in the dollar but the bond market is giving it a hard time by persisting with higher yields. The correlation is not always one-for-one.

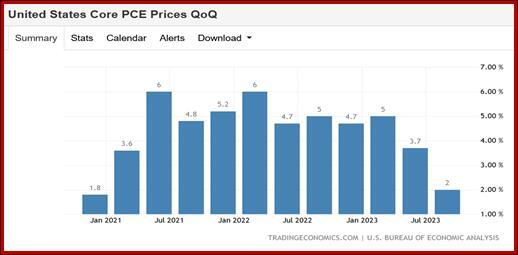

We are inclined to see euro buyers come back with some upward momentum to at least 1.0960 (resistance) and perhaps beyond—but not until next week. And next week we get US core PCE, likely a very soft number on the mom and 6m/6m basis, restoring the early rate cut idea. The dollar isn’t toast but the outlook is not bright.

Tidbit: Again we don’t know how to judge developments in China. Upfront and obvious is the drop in the equity indices, with the FT attributing the latest move down to the early release of GDP and population growth at Davos, interpreted to mean no stimulus, which investors want. Bloomberg reports a broker has suspended short-selling “for some clients.” Also, China has told local governments to delay or halt some state-funded infrastructure projects, according to Reuters. Finally, China wants something done about the Red Sea problem that is harming its exports to Europe.

The question remains whether the world’s second largest economy sliding down a rabbit hole can affect everyone else in the same way—this is the contagion problem that is still murky. Nobody is naming it “contagion” yet. We will know the answer when the press starts quoting investors using that precise word.

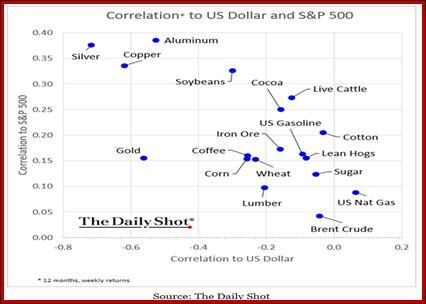

Tidbit: The Daily Shot (from the WSJ) published this weird chart yesterday. If we understand it, there is only one commodity positively correlated with the dollar, and that’s natural gas. But it’s a tiny, tiny number. All the rest of the commodities are inversely correlated, with the critical one, copper, among the most negative.

Brent crude has nearly the same correlation number as sugar, lean hogs and cotton. We don’t know the timeframe of this exercise but that last one seems inconsistent with experience. When the price of oil rises by a lo, the dollar does go down at the same time. It’s not a hard and fast rule and over the years we have struggled to explain it.

Notice that everything is positively correlated with the S&P, with the industrial metals at the high end. This makes sense. The correlation of gold with the S&P does not make sense. It’s about the same as coffee, corn and lean hogs. We agree that gold movements are not an equity market driver, but coffee, corn and lean hogs?

To be fair, the chart is not referring to prices but rather to returns for the past year on a weekly basis. We are not sure it’s terribly useful.

Tidbit: As noted before, the ECB is trying to rein in overly optimistic expectations of early rate cuts. The ING FX analyst wrote in FXStreet that “The European Central Bank is more cautious about the growth outlook but far from relaxed about inflation. The minutes of the ECB’s December meeting show that the Bank was still far away from discussing rate cuts. This is unlikely to change at next week’s meeting.” We should always cheer anyone with the patience to read central bank minutes.

In the US, Fed minutes are as much public relations as anything about the real economy. The ECB minutes seem to be more transparent: “The only mention of rate cuts in the minutes was when talking about market expectations. In the ECB’s policy discussion, there was no debate on rate cuts. Instead, ‘it was stressed that there was no room for complacency and that it was not the time for the Governing Council to lower its guard. Caution was warranted, as inflation would probably pick up in the near term and there were continued uncertainties in relation to wages and underlying inflation dynamics. This suggested that it was still too early to be confident that the task had been accomplished.’”

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.